82% of SME’s in the GCC rely in cross-border trade as primary revenue generator – UPS Survey

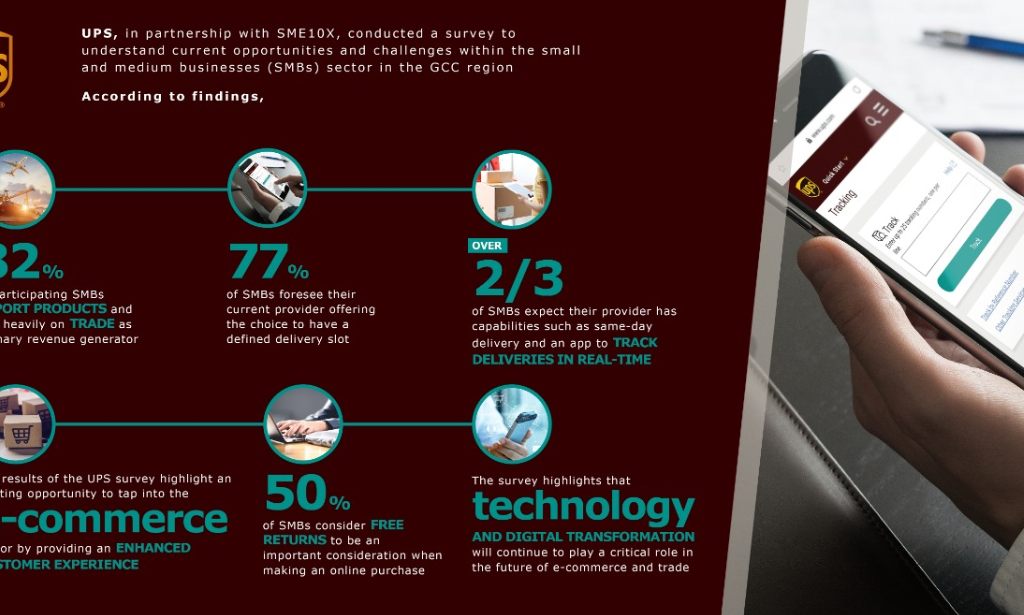

UPS announced the findings of a survey which captures current shipping behaviors and trends among small and medium businesses in the UAE and across the GCC. The results highlight that 82% of participating SMBs export either regularly or intermittently, which reveals that most of them are heavily dependent on trade as the primary channel for revenue generation.

“With a rising number of small businesses entering the e-commerce space, there is a continuing need to work with logistics providers who are able to keep pace with the technological requirements and demands of a fast-changing online world,” said Hussein Wehbe, managing director for UPS in the Middle East. “The survey also shows that companies expect their logistics partners to support them in areas such as providing with a variety of service options, customs brokerage and transit time visibility. Small businesses understand that the capabilities of their logistics partners are as important as their own to become or remain competitive in the global marketplace.”

The survey also demonstrates the current opportunities and challenges within the logistics sector for SMBs amidst the e-commerce landscape, the increasing digitalization and the preferences of customers. Whilst the majority of businesses are satisfied with their current logistics provider, 36% would consider switching to a new partner. The report also reveals that the majority of SMBs expect their provider to have capabilities such as same-day delivery (69%), a time-definite delivery option (77%) and a digital application to track deliveries in real-time (62%).

“With increasing penetration of high-speed connectivity across the region, online retail continues to grow faster compared to physical retail,” said Renzo Bravo, Head of Strategy and Marketing for Indian subcontinent, Middle East and Africa (ISMEA) at UPS. “This survey highlights that technology and digital transformation will continue to play a critical role in the future of e-commerce and trade. Small businesses must use data and technology to continue to understand their customers’ needs, expand their services and select the right partners to meet the requirements of the demanding online shopper.”

The e-commerce market in MENA has the potential to grow 3.5 times by 2022, reaching a total market size of $28.5 billion. That said, surprisingly, 64% of SMBs currently do not offer online sales.

“The results of UPS’s survey highlight an opportunity to tap into the online marketplace by providing an enhanced customer experience,” added Bravo. “50% of the SMBs surveyed believe that their customers prefer the option of free returns, giving them the freedom to choose whether they like the product or not. This echoes a global sentiment of online shoppers looking to make purchases from companies that they trust.”

UPS commissioned UAE-based SME10X to conduct the survey within the local SMB sector to understand sentiments and outlook towards e-commerce. SME10X covered a large sample of more than 5,000 SMBs in the GCC across key sectors including manufacturing, services and trading, and analyzed the results based on the participation of 1,153 respondents.

Kuwaiti developer URC signs with Ahmadiah Contracting for the Commercial District development at Hessah AlMubarak

Kuwaiti developer URC signs with Ahmadiah Contracting for the Commercial District development at Hessah AlMubarak