The Countdown Begins

After a lengthy build-up, 2017 will be the year that construction activity really begins to crank up on the site of Expo 2020 Dubai. But are they cutting it a bit fine?

Preparations for what is likely to be the biggest event ever hosted in the Gulf region are gathering pace following the news that the bulk of construction contracts for the site are set to be awarded this year.

The organisers of Expo 2020 Dubai announced last month they will hand out 47 construction contracts worth a huge AED 11bn ($3bn) over the course of 2017. At the same time it was revealed that just before the turn of the year an Orascom-Besix joint venture had bagged a major contract to carry out deep infrastructure work at the Expo site in Dubai South.

Additional construction contracts to be awarded this year include the third and final infrastructure package for the events support areas, including car parking. Other key awards include the contracts to build the three thematic districts that will host the majority of the pavilions, as well as the public areas and the design, development and delivery of all temporary architecture and infrastructure required to stage the event.

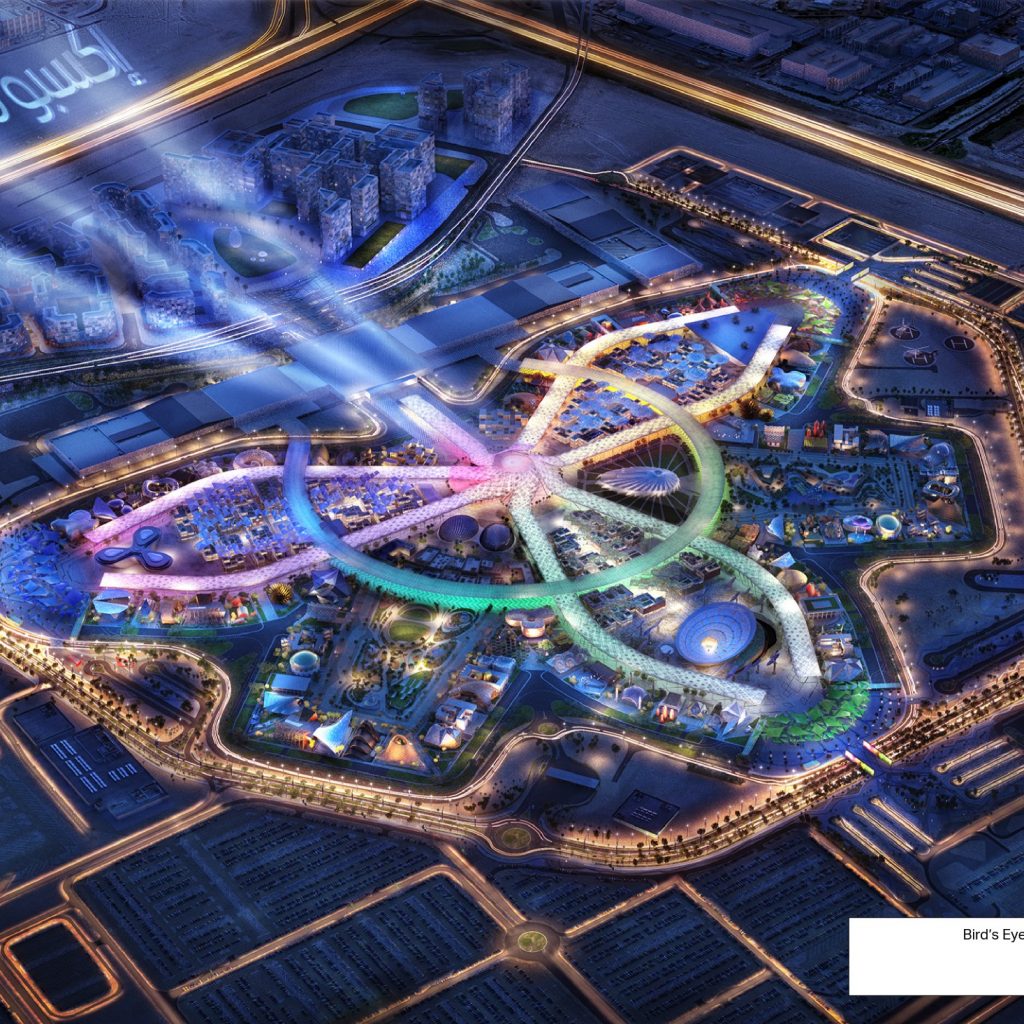

The Expo 2020 Masterplan

We are committed to working with leading businesses from across the world in order to deliver an exceptional event of this scale, on time and on budget, Her Excellency Reem Al Hashimy, UAE Minister of State for International Cooperation and Director General, Dubai Expo 2020 Bureau, said in February.

This is particularly true when it comes to the development of the physical site, which will live on long beyond 2021 to become an anchor for the UAEs developing knowledge economy in Dubai South.

Once complete, the Expo site will cover 4.38 km2 and host up to 300,000 people a day during the six months of the event which runs from October 2020 until April 2021.

Ahmed Al Khatib, Vice President of Real Estate & Delivery, Expo 2020 Dubai, said: While 2016 was an important year for design, 2017 is when the momentum of construction will really build, ahead of international participants beginning work on their pavilions in 2018.

He added: These important contracts will help us meet our target of completing the majority of construction with a year to go before Expo 2020 Dubai opens its doors in October 2020, providing the opportunity for all-important readiness testing.

Early works on site are now complete, with more than 4.7 million cubic metres of earth moved – enough to fill about 1,800 Olympic sized swimming pools. The first infrastructure contract, covering the deep infrastructure of the non-gated Expo area, including the Expo Village, was awarded to Tristar Engineering and Construction in July 2016 and is due to be completed by April 2018. The aim is to have the site ready for participants to begin work on their respective pavilions by that date.

A challenging timeline

All infrastructure work is due to be complete by October 2019, exactly one year before the six-month event kicks off. But with many of the major contracts still to be awarded, is the government going to achieve its aim of having everything ready by then?

They are cutting it all a bit fine, says David Clifton, Regional Development Director. I can understand the logic of delaying until the latest possible moment as this will delay the high OpEx costs associated with keeping the Expo site running at the level required. I would suspect that the drop dead date to have the site complete will be six months prior to the commencement date in October 2020 to allow successful ORAT (Operational Readiness and Transfer) to the operations team.

However, a recent study by MEED indicates that the average contract build time in the UAE is 36 months but the average build time is between 48-50 months dependent on asset type. This would suggest that the true critical path has passed. There are concerns subsequently that the delivery could be late.

He added: Thats not to say the completion cant meet the schedule, but the probability is that a 24/7 working pattern will end up occurring on larger contracts, which would end up adding additional costs to the delivery programme. Companies will need to fast track projects in the main. Some packages will be easy to achieve, but larger and more complex packages will need to be accelerated.

Clifton details a number of key challenges involved in fast tracking projects to get the site ready in time.

Time with a tightening timeline, certain programmes are likely to shift towards 24/7 construction.

Supply Chain Since so many packages will be running concurrently, suppliers may well be constrained in terms of delivery. Since the global financial crisis when organisations shrunk considerably, few companies are willing or able to expand quickly to fulfil what is a short term project. Without a guaranteed, sustainable pipeline of work to maintain a larger organisation, most wont expand. This means that there could well be a competition for short term resource at the project peak load in 2018/19

Costs Inflation will occur due to constrained short term capacity in the supply chain. Couple that with the introduction of VAT in 2018 in the UAE and we forecast that inflation will be 3 percent in the industry this year and up to 6 percent in 2018.

Overarching Manpower Has the main contractor got the available manpower in the short term to shift to a 24/7 operation if required? Noting that few wish to expand quickly for a short term scheme, contractor capacity in 2018 must be of concern for the delivery programme.